Discovering the Solutions Offered in Offshore Business Formations: What You Need to Know

Offshore company formations provide a variety of services made to help with business success while ensuring conformity with legal needs. These solutions can include firm registration, lawful advice, and plans for privacy through candidate directors. Additionally, considerations around tax obligation optimization and property defense are crucial. Comprehending these elements can substantially influence one's decision-making procedure. Nonetheless, the intricacies of choosing the best territory and guiding with guidelines elevate better inquiries. What should one consider next?

Recognizing Offshore Business Structures

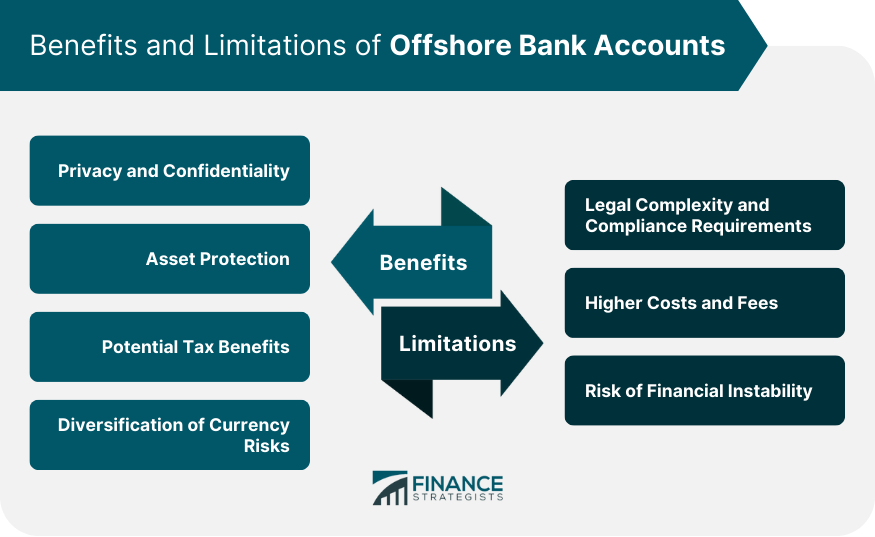

What defines an overseas company structure? An offshore company is normally signed up in an international jurisdiction, frequently defined by positive governing atmospheres and confidentiality. These structures are designed to provide lawful splitting up in between the business's assets and its proprietors, enabling a variety of functional and financial benefits. Offshore business can be developed as different kinds, including limited liability companies (LLCs), companies, or trusts, depending on the regulative framework of the chosen territory.

Key features of these frameworks include improved privacy, property security, and ease of global service deals. Additionally, they commonly require minimal neighborhood visibility and can assist in the monitoring of investments throughout borders. The selection of a particular overseas jurisdiction can significantly influence the functional capacities and conformity demands of the firm. On the whole, comprehending the ins and outs of overseas company frameworks is vital for entrepreneurs and investors looking for to enhance their service techniques.

Tax Obligation Advantages of Offshore Business

Offshore companies supply substantial tax benefits that can improve productivity and monetary effectiveness for organization proprietors. One of the main advantages is the capacity for minimized corporate tax obligation prices, which can be notably lower than those in the owner's home nation. Many overseas territories supply tax obligation incentives, such as tax vacations or exemptions on certain types of income. Additionally, offshore business might profit from favorable tax obligation treaties, enabling the reduction or elimination of withholding tax obligations on rewards, nobilities, and interest. This can result in increased capital and far better reinvestment possibilities. Some overseas entities can run under a territorial tax obligation system, which just taxes earnings produced within that territory. This structure can be specifically useful for businesses participated in global profession or online services, enabling them to maximize their tax obligation commitments while preserving conformity with global guidelines. Overall, these tax benefits can greatly add to lasting financial success.

Privacy and Privacy Attributes

How can entrepreneur guard their delicate details while gaining from international opportunities? Offshore business formations offer robust personal privacy and privacy features that interest business owners looking for discretion (Offshore Company Formations). Numerous jurisdictions provide candidate solutions, allowing people to assign third events as shareholders or directors, thus hiding their identities from public documents

In enhancement, rigorous information protection laws in numerous offshore regions guarantee that delicate info continues to be personal. Offshore business typically gain from boosted banking privacy, with guidelines that secure client identities and monetary transactions.

Furthermore, using personal addresses for signed up offices lessens direct exposure to public analysis.

These privacy procedures enable business proprietors to run with higher self-confidence, knowing their delicate data is safe. By leveraging these functions, business owners can concentrate on critical development chances without the consistent worry of details direct exposure.

Asset Defense Approaches

While steering with the intricacies of international business, entrepreneurs need to focus on possession protection to secure their wealth from possible dangers. Offshore company formations supply robust approaches for reducing exposure to legal insurance claims, financial institution activities, and political instability. One reliable method entails establishing a restricted liability firm (LLC), which divides individual possessions from organization obligations, consequently providing a shield versus claims.

Additionally, entrepreneurs can make use of depend hold properties, ensuring they remain shielded from lenders and legal disputes. Jurisdictions with solid property security regulations, such as Nevis or the Chef Islands, are usually favored for their beneficial guidelines. Applying proper insurance plan and diversifying investments further boosts safety, reducing vulnerability to market variations. Generally, utilizing these strategies within an overseas framework not just promotes riches conservation however additionally fosters lasting monetary stability, allowing business owners to concentrate on growth and advancement without undue worry over property exposure.

Opening Offshore Bank Accounts

Opening offshore checking account includes comprehending the various account types offered, which can deal with various economic requirements. Furthermore, the documents procedure is important, as it typically needs certain kinds of identification and evidence of house. This overview will certainly make clear the options and requirements for people and services seeking to develop overseas banking partnerships.

Account Kind Used

Offshore savings account come in numerous types, each made to satisfy various economic demands and objectives. Personal accounts are customized for individuals looking for privacy and asset defense, while company accounts facilitate company purchases and monitoring of company funds. Multi-currency accounts are preferred among international capitalists, permitting purchases throughout various money without extreme conversion costs. Additionally, cost savings accounts provide interest on deposits, attracting those wanting to expand their possessions safely. Some financial institutions additionally offer investment accounts, giving customers access to numerous investment opportunities. Each account type might feature distinct advantages and features, permitting customers to pick the one that aligns ideal with their monetary strategies and purposes. Comprehending these options is fundamental for efficient overseas banking.

Needed Paperwork Refine

To efficiently open read this post here an overseas bank account, potential customers must prepare a collection of particular papers that please regulative needs. This commonly includes a legitimate ticket or government-issued recognition to validate identity. Clients are additionally called for to offer proof of residence, such as an utility expense or copyright, dated within the last three months. In addition, a comprehensive summary of the resource of funds is essential to ensure compliance with anti-money laundering regulations. Some banks might request a service plan or recommendation letters, particularly for company accounts. Each jurisdiction may have special needs; as a result, seeking advice from an expert in overseas solutions is a good idea to establish all paperwork is complete and precise, helping with a smoother account opening site web process.

Conformity and Regulatory Considerations

Navigating the intricacies of conformity and regulative considerations is essential for any type of entity seeking overseas firm formations. Entities should abide by different international and local legislations that control financial activities, taxation, and business governance. Secret laws frequently include anti-money laundering (AML) legislations, recognize your customer (KYC) procedures, and reporting demands to guarantee openness.

Companies must remain alert about adjustments in regulations that might influence their operational status. Failure to abide can lead to extreme penalties, including penalties or the dissolution of the firm. Engaging with legal and financial specialists that focus on overseas policies can provide vital support in steering with these complexities.

Additionally, understanding the ramifications of tax obligation treaties and international arrangements is basic for keeping compliance. Companies must prioritize developing robust compliance structures to mitigate risks and assure long-term sustainability in their offshore ventures.

Choosing the Right Offshore Territory

Just how next does one figure out the most ideal overseas jurisdiction for firm development? The option of jurisdiction is crucial and involves a number of elements. One should examine the legal framework and regulations governing business in potential territories. Favorable tax obligation regimens, such as low or no corporate tax obligations, are usually a primary factor to consider. In addition, the political stability and online reputation of the jurisdiction play significant duties in making sure the security of properties and conformity with international requirements.

The availability of financial solutions and the convenience of doing company must not be overlooked. A territory offering robust privacy arrangements can additionally be advantageous for those seeking personal privacy. Examining the prices associated with company development, upkeep, and potential legal fees is essential. By evaluating these aspects, one can make a notified decision, ensuring that the selected offshore territory aligns with their service goals and functional demands.

Regularly Asked Inquiries

The length of time Does the Offshore Business Development Process Usually Take?

The overseas business development process commonly takes anywhere from a couple of days to numerous weeks. Offshore Company Formations. Factors affecting this timeline include jurisdiction, paperwork completeness, and particular company associated with the formation procedure

What Are the Preliminary Prices Associated With Setting up an Offshore Firm?

The initial prices for establishing an overseas business can vary extensively, normally encompassing enrollment costs, legal costs, and added fees for services like checking account arrangement and compliance, often totaling numerous hundred to a number of thousand dollars.

Can People Type Offshore Companies Without Expert Aid?

Individuals can technically form overseas firms individually; nevertheless, they typically experience complicated legal and regulative requirements. Offshore Company Formations. Specialist assistance is advised to navigate these obstacles successfully and ensure compliance with relevant regulations and guidelines

What Papers Are Needed for Offshore Company Enrollment?

The documents required for overseas company registration normally consist of recognition proof, an in-depth service plan, proof of address, and, in some jurisdictions, an affirmation of beneficial ownership and resolutions from supervisors.

Exist Ongoing Upkeep Fees for Offshore Companies?

Ongoing maintenance fees for offshore firms are generally required to guarantee conformity with neighborhood regulations. These charges may include yearly renewal charges, registered agent solutions, and accounting, varying by territory and particular business structure.